Gold Hits New Record High As China Moves To De-Westernize Global Bullion Market

The Gold rally has accelerated since August and delivered a +12% return over the past month – 98th percentile for monthly returns since 1980 – supported by rising futures positioning and ETF inflows, as well as a seasonal pick-up of central Bank demand.

Overnight, however, Gold climbed to a fresh record, with traders weighing China’s new plan to become a custodian of foreign sovereign gold reserves.

Bloomberg reports that The People’s Bank of China is using the Shanghai Gold Exchange to court central banks in friendly countries to buy bullion and store it within the country’s borders, said the people, who spoke on condition of anonymity as the discussions aren’t public. The effort has taken place over recent months and has attracted interest from at least one country, in Southeast Asia, the people said.

The move would enhance Beijing’s role in the global financial system, furthering its goal of establishing a world that’s less dependent on the dollar and Western centers like the US, the UK and Switzerland.

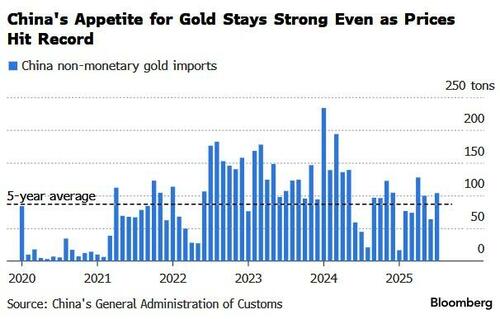

Countries have been snapping up gold as a hedge against mounting geopolitical risks, creating the opportunity for the PBOC to offer a haven for an asset deemed crucial as a buffer to economic shocks.

While China’s move marks another step toward building its role in global bullion trading, it remains some way from challenging established hubs such as the UK.

Boosting local trading even further should help Beijing accelerate its campaign to reduce reliance on the dollar and internationalize the yuan.

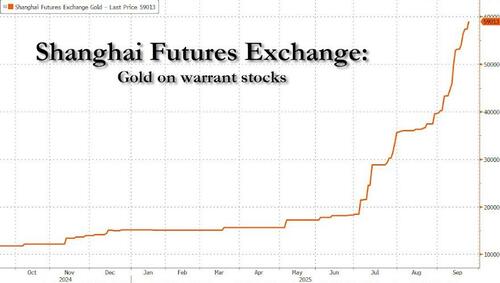

China has already taken a number of steps to open up its gold market. The SGE launched its first offshore vault and contracts in Hong Kong this year, a move designed to increase transaction volumes in the yuan. The PBOC has also recently eased restrictions on gold imports.

For prospective clients, Chinese vaults could be an attractive option to build reserves and help bypass the risk of being cut off from the world’s financial markets.

Central bank buying of gold accelerated after the US and its allies froze Russia’s foreign exchange reserves in 2022 after the invasion of Ukraine.

“China’s trying to become a bigger and more influential part of the financial infrastructure,” said Nicholas Frappell, Head of Institutional Market at ABC Refinery..

“If countries chose to store their gold in China, they will forgo the ease and liquidity in London.”

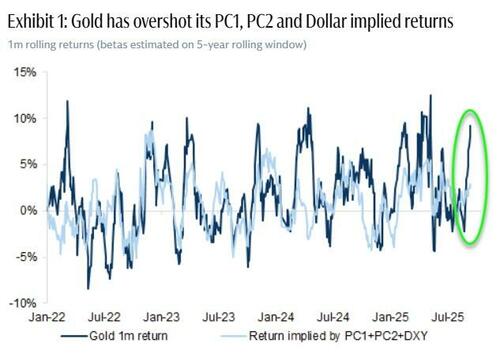

But, it’s not all Goldilocks for the precious metal as Goldman’s Portfolio Strategy team warns that while the recent dovish policy repricing combined with a weaker dollar are tailwinds for Gold, the recent rally indicates some overshoot relative to its implied beta to macro pricing across assets (captured by our PC1 „Global growth” and PC2 „Monetary policy” factors and DXY, Exhibit 1).

While Goldman’s commodities team continues to see upside risks for their $4,000/toz mid-2026 forecast, speculative positioning has picked up materially.

It’s not just central banks and speculators that are seeing the appeal of precious metals as BullionStar reports experiencing unprecedented demand in their Signapore office even as precious metals hit record prices.

We’re seeing three clear patterns emerge:

1) High-net-worth individuals and family offices are making substantial allocations to physical gold.

2) Regular investors are converting their savings into precious metals.

3) First-time buyers entering the precious metals market, who’ve been watching from the sidelines but now realize waiting is riskier than acting.

Granted they are a gold retailer but the anecdote confirms a broad industry trend.

And we suspect any short-term selling fears from speculators (highlighted by Goldman) will be soaked up by China’s new hording and accelerating retail demand.

For the latest thoughts from Goldman’s trading desk on gold, see this note available to pro subs

Tyler Durden

Tue, 09/23/2025 – 11:45