Barclays customers face a potential £1,300 loss in purchasing power by keeping savings in the wrong account, an expert has warned. The stark calculation comes as inflation unexpectedly jumped to 3.8% in July, significantly outpacing most savings rates.

Anna Bowes, a savings specialist from The Private Office, highlighted the severe impact of Barclays' poor interest rates on customers' finances. Speaking to Sky News, she warned that savers with standard accounts could be hit particularly hard by rock-bottom returns amid soaring inflation.

The bank's Everyday Saver account offers just 1.11% interest, leaving customers far behind inflation. Bowes explained that a basic-rate taxpayer with £50,000 in this account would take home a net return of less than 1%, at just 0.89%.

A competitive account paying around 4.5% would deliver 3.6% after tax for basic-rate taxpayers and 2.7% for higher-rate taxpayers. The mathematical impact is stark: £50,000 left in the Barclays account would have a real value of £48,589 after inflation, compared to £49,904 in the competitive account.

Market conditions worsen

The savings market has deteriorated following last week's inflation surge. Cahoot closed its Simple Saver paying 4.55% and reissued a new version at just 4.4%, while West Brom Building Society withdrew its Four Access Saver paying 4.55% entirely.

The Bank of England now predicts inflation will peak at 4% in September, up from its previous forecast of 3.5%. This has triggered expectations that interest rate cuts will be delayed until later this year.

Industry criticism

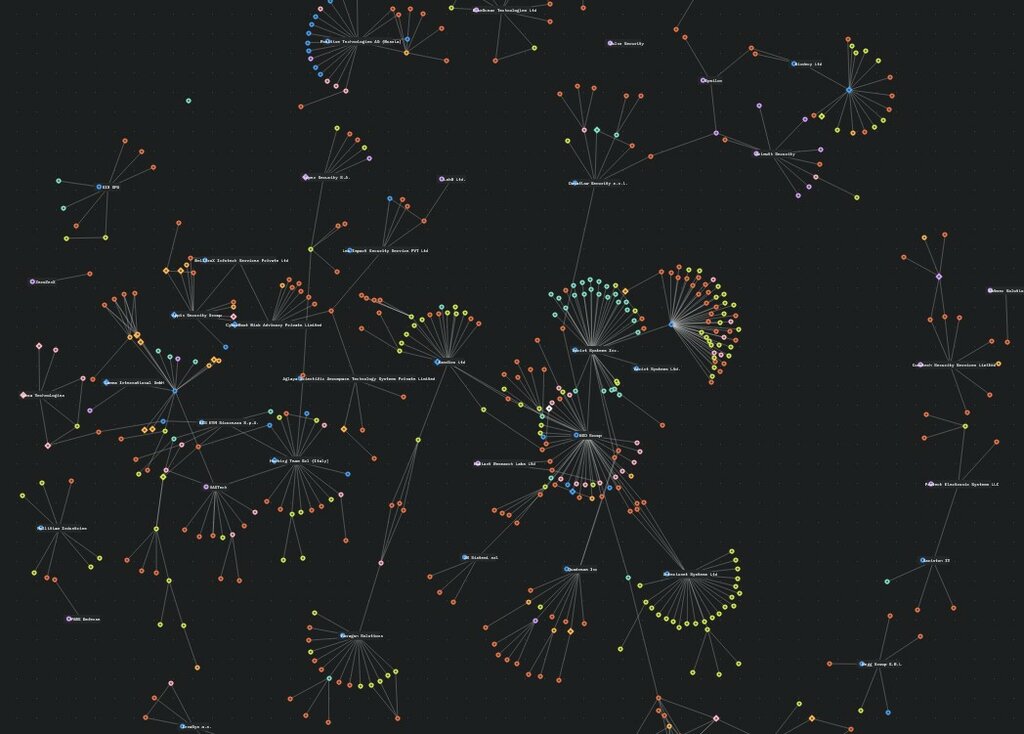

Kundan Bhaduri from The Kushman Group delivered a scathing assessment of the savings industry. He said: "The savings industry has mastered the art of offering infinite choice in a market designed to fleece customers. There's shockingly 2,000+ ways to lose money to inflation, each wrapped in marketing."

Catherine Mann from the Bank's Monetary Policy Committee warned that swift action on inflation prevents future persistence. She cautioned that failing to control inflation now would require "even tighter policy" later.

Financial experts now advise shopping around for the best available rates, even though none can currently beat inflation for taxpayers. Basic-rate taxpayers need a gross return of 4.75% to match inflation, while higher-rate taxpayers require an impossible 6.33%.

Sources used: "Daily Star", "Mirror", "Liverpool Echo", "Birmingham Mail", "Express", "Sky News" Note: This article has been edited with the help of Artificial Intelligence.