What Ceasefire: European Gas Prices Jump After Ukraine Blows Up Key Gas Pumping Station In Russia In „Act Of Terrorism”

So much for that ceasefire.

European natural gas prices jumped after an attack on a pumping station in Russia’s Kursk region (formerly held by Ukraine mercenaries until their recent hasty retreat), which formed part of a link that sent fuel to the continent until recently, and which Moscow accused Ukraine of attacking in an „act of terrorism”.

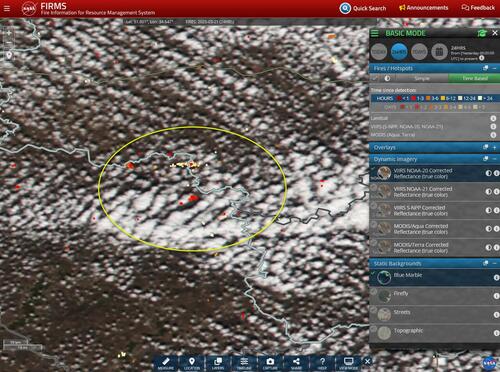

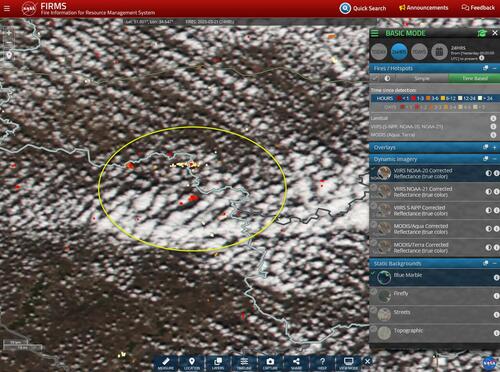

Footage of an alleged fire at the Sudzha gas metering station in Russia’s Kursk Oblast, published on March 20, 2025. (Screenshot / ASTRA)

Footage of an alleged fire at the Sudzha gas metering station in Russia’s Kursk Oblast, published on March 20, 2025. (Screenshot / ASTRA)Russia on Friday accused Ukraine of deliberately blowing up the key gas pumping and measuring station in the Kursk region near the Ukrainian border which was under the control of Ukrainian Armed Forces since last August before the area was reclaimed by Russian forces this month, in what it called „an act of terrorism.”

Meanwhile, Ukraine as always played the idiot card, and accused Russia of attacking its own energy facility: the country’s General Staff of the Armed Forces confirmed the Sudzha gas metering station was shelled, but said it was Russians who struck their own facility (just like Ukraine previously accused Russia of blowing up the Nord Stream), pointing to previous instances in which Russia appeared to send soldiers through a disused natural gas pipeline.

In a post on Facebook, the General Staff said the accusations were „baseless,” and part of a „discrediting campaign against Ukraine…The mentioned station was repeatedly shelled by the Russians themselves.”

The transit point is part of a Gazprom pipeline link that, until the start of this year, brought Russian gas to Europe. Some countries that previously depended on those flows had hoped they would eventually resume. NASA satellite imagery indicated wide-scale fires covered the gas-station area and the surrounding territory.

Source: NASA

Source: NASA“Those in the gas market that hope Russian exports may resume along this transit line when the war ends will now be looking to gauge the extent of the damage to the infrastructure and crucially how quickly it could be repaired by Gazprom,” said Tom Marzec-Manser, an independent gas analyst.

Whoever was behind the attack, the damage will make the resumption of Russian gas supplies more unlikely, a prospect that was already in retreat after a 30-day ceasefire didn’t immediately emerge as a first step toward a peace deal. Russia and Ukraine’s leaders indicated they’d agree to a ceasefire on attacking energy infrastructure, but so far that has not led to a halt in attacks.

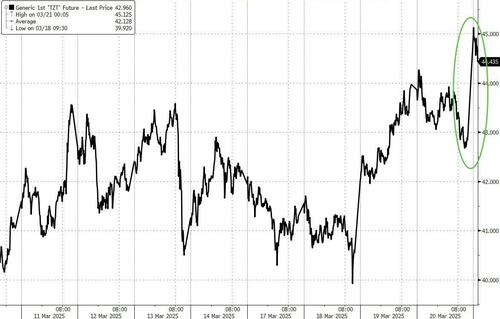

Dutch front-month futures (TTF), Europe’s gas benchmark, were 2.3% higher at €43.84 a megawatt-hour by 12:07 p.m. in Amsterdam. Earlier they rose as much as 6.2% in early trading on Friday. But price gains eased in the course of the morning as traders digested the limited short-term impact from the blast. In addition to the link not being used currently, damage could be repaired if there were a political decision to resume flows.

“A fix could range from weeks to a year or two, depending upon the availability of replacements and the severity of the damage,” said Ronald Smith from Emerging Markets Oil & Gas Consulting Partners LLC.

“The major issue here remains one of finding a political resolution to the conflict and restarting full economic relations between Europe and Russia, not so much in the infrastructure.”

Yes, a simple fix.

That said, there could be multiple routes for Russia to send gas to Europe… if the political opportunity presents itself. The country used several cross-border points in the past, but their number fell to two by 2022 after Moscow launched its full-scale invasion. In May that year, supplies via the Sokhranivka point stopped after Ukraine said it can’t control the facility because of occupied forces.

Flows of Russian fuel through Ukraine ended at the start of this year when a transit agreement expired, and expensive liquefied natural gas cargoes – mostly from the US – leave Europe exposed to competition with other buyers. Soaring energy prices is also why Europe has been mired in a permanent recession since 2022 and no amount of German debt-issuance to „defend from Russia” can fix that. The continent faces a challenging stockpiling season after stronger-than-usual withdrawals this winter have left gas reserves at their lowest levels since 2022.

Friday’s market reaction suggests “at least a partial resumption of flows had been factored by the market,” said Bloomberg Intelligence senior analyst Patricio Alvarez. “Absent any geopolitical-driven supply shifts, European gas markets are poised to tighten this summer as the region works to plug a wider storage reinjection gap.”

Tyler Durden

Fri, 03/21/2025 – 09:20